Posted Mon, Mar 25, 2024 2:08 PM

Nigeria's External Trade improved, while Trade Surplus shrank in 2023

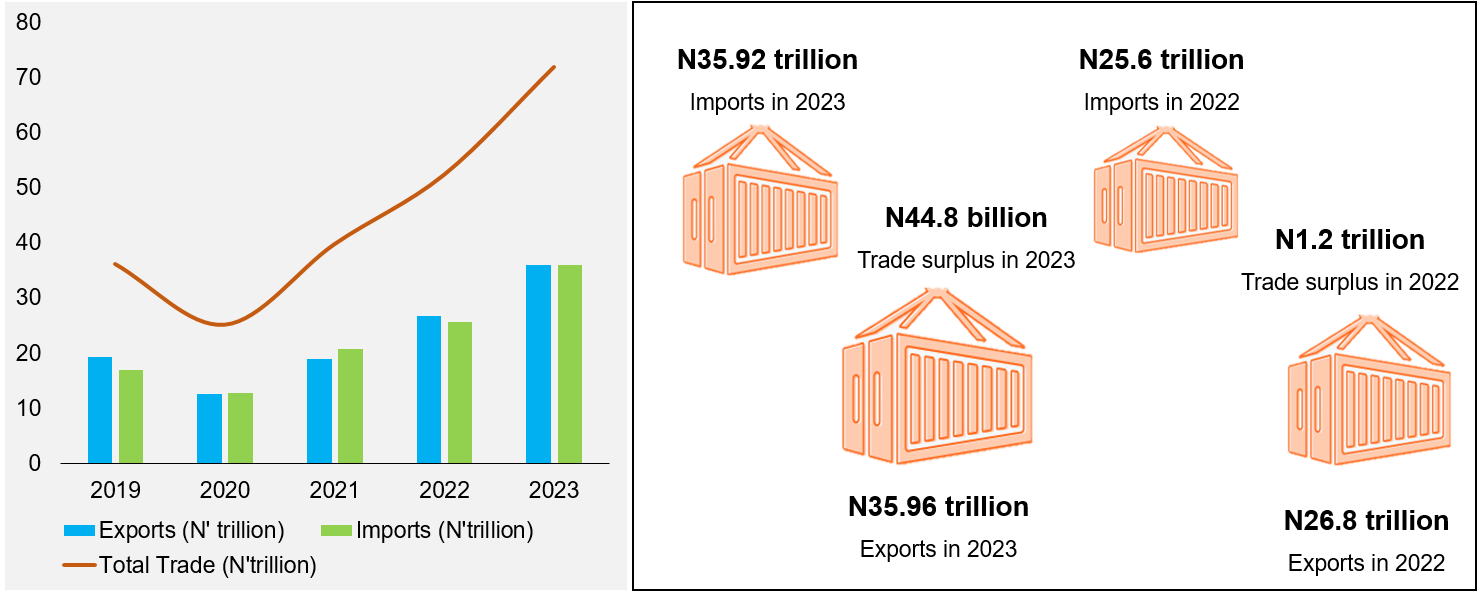

The external trade value jumped by 37.2 percent to N71.9 trillion in 2023 from N52.4 trillion in 2022. This was primarily driven by the growth in exports, which outpaced that of imports, resulting in a trade surplus of N44.8 billion, representing a significant decline relative to a trade surplus of 1.2 trillion in 2022. Despite the improvement in external trade, the value of Nigeria’s intra-African trade remained weak and fell from N5 trillion in 2019 to N3 trillion in 2021 before rising to N4.6 trillion in 2023. Despite this improvement, Nigeria's share of intra-African trade halved from 13.9 percent in 2019 to 6.4 percent in 2023. This implies that the African Continental Free Trade Area (AfCFTA) agreement has had limited progress and signifies poor readiness to harness the gains from regional integration.

Notwithstanding, the total value of goods exported rose to N35.96 trillion in 2023 from N26.8 trillion in 2022. This is attributable to the increase in both oil exports (N32.82 trillion) and non-oil exports (N3.14 trillion) compared with their respective performances in 2022. The oil exports mainly benefitted from elevated global oil prices and increased domestic crude oil production, which averaged US$85/barrel and 1.4 million barrels/day, respectively, in 2023. Meanwhile, the current oil production remains below the 2.2mbpd capacity recorded ten (10) years ago. To guarantee continuous improvement in domestic crude oil production, the Nigerian government needs to address the perennial challenges facing the oil and gas sector, including oil theft, ageing infrastructure, and low investments (domestic and foreign). These structural bottlenecks have, in turn, prompted divestments from the sector in recent times.

Data: NBS; Chart: NESG Research

Similarly, non-oil exports – which accounted for 8.7 percent of total export earnings in 2023 – rose to N3.14 trillion in 2023 from N2.56 trillion in 2022, primarily driven by the sharp increase in the earnings from agricultural products (N1.2 trillion in 2023 versus N598.2 in 2022). This suggests the need to broaden financial and non-financial support to players across the agricultural value chain to ramp up the country's local production of agricultural products. This is because Nigeria is losing in the global market by selling low value-added agricultural products. According to the Nigerian Export-Import Bank, Nigeria loses about US$200 billion annually for not exporting processed cocoa[1].

On the flip side, the value of imported commodities rose sharply to N35.92 trillion in 2023 from N25.6 trillion in 2022. This is attributable to the increase in import bills across the various tradable items. The most significant increase was recorded in favour of machinery & transport equipment and mineral fuels. The increase in the overall import value could be partly due to the rapid exchange rate depreciation arising from harmonising the multiple official exchange rates. Hence, the Nigerian government must be deliberate in revitalising the country's refineries, as this would improve investors' confidence in the system. To augment the refined petroleum products from the Dangote Refinery, the Federal Government should quicken the refurbishment of the Port Harcourt refinery. Additionally, when the local refineries start working to speed, it would reduce Nigeria’s reliance on imported fuel products, reduce the pressure on the Naira, and boost foreign exchange savings to be channelled to other important uses.

Find a blog post

Latest Releases

_1731941578.png)

Leveraging Artificial Intelligen .. Read

4 days ago

Second Consecutive Increase: Hea .. Read

1 day ago

The Dynamics of Access and Influ .. Read

4 days from now