Posted Thu, Jun 13, 2024 7:24 PM

Nigeria's External Trade more than doubled and Trade Surplus improved in 2024 Q1

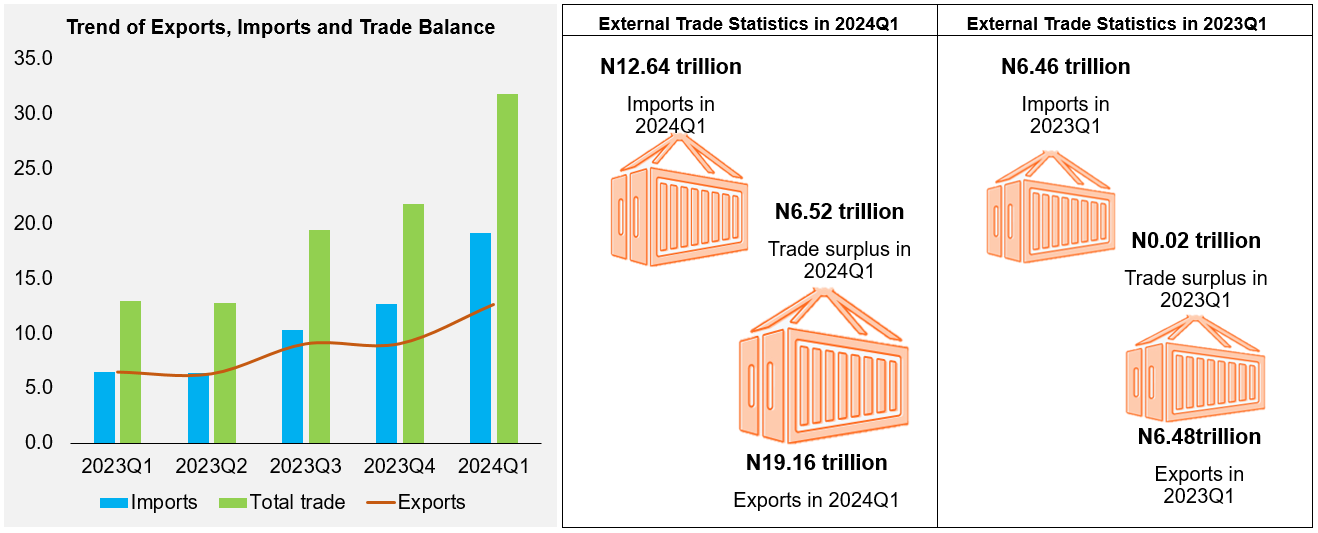

The external trade value jumped to N31.8 trillion in 2024Q1 from N12.95 trillion in 2023Q1, driven by the growth in exports, which outpaced that of imports, resulting in a trade surplus of N6.5 trillion. This represents a significant improvement relative to a trade surplus of N20.9 billion and N3.6 trillion recorded in 2023Q1 and 2023Q4, respectively. According to the NBS data, in 2024Q1, Nigeria exported crude oil to three (3) African countries, including South Africa, Ivory Coast and Senegal, whereas non-oil exports to these countries were meagre. This suggests the need to promote value-added products to leverage the African Continental Free Trade Area (AfCFTA) agreement so as to have a diversified export market.

Notwithstanding, the total value of goods exported more than tripled from N6.5 trillion in 2023Q1 to N19.2 trillion in 2024Q1. This is attributable to the increase in both oil exports (N17.4 trillion) and non-oil exports (N1.8 trillion) in the quarter compared with their respective performances in 2023Q1. The oil exports mainly benefitted from elevated global oil prices and increased domestic crude oil production, which averaged US$85.6/barrel and 1.6 million barrels/day, respectively, in 2024Q1. However, the country still depends on imported refined petroleum products, which account for about 80 percent of the local demand for fuel products. This suggests the need to restore operations at the local refineries to complement the refining capacity of the Dangote Refinery, which commenced operations in 2024Q1. There is also an urgent need to fix power outages to reduce the exposure of households and businesses to fossil fuels.

Data: NBS; Chart: NESG Research

Data: NBS; Chart: NESG Research

Similarly, non-oil exports – which accounted for 9.4 percent of total export earnings in 2024Q1 – rose to N1.8 trillion in 2024Q1 from N663.8 billion in 2023Q1, primarily driven by the sharp increase in the earnings from agricultural products (N1.0 trillion in 2024Q1 versus N279.6 in 2023Q1). Meanwhile, there is an urgent need to boost non-oil exports to sustain the favourable trade balance position. Persistent insecurity continues to ravage the major food-producing regions. Therefore, tackling insecurity would boost agricultural productivity vis-à-vis agricultural exports and rein in food inflation, which averaged 37.8 percent in 2024Q1. Similarly, the Manufacturing sector’s performance is being adversely affected by divestments; hence, there is a need to create an enabling environment for businesses to thrive and expand.

On the flip side, the value of imported commodities rose sharply to N12.6 trillion in 2024Q1 from N6.5 trillion in 2023Q1, attributable to the increase in import bills across the various tradable items. The most significant increase was recorded in favour of machinery & transport equipment and mineral fuel. However, the share of mineral fuel and machinery & equipment in the total imports fell, while the share of chemical imports was flat. Moreover, in 2024Q1, Nigeria was a net importer of solid minerals, raw materials and manufactured goods. Additionally, the higher import value was largely driven by exchange rate depreciation. The average official exchange rate rose more than three-fold to N1,307.6/US$ in 2024Q1 from 418.6/US$ in 2023Q1. This has translated to higher imported food inflation, which averaged 37.8 percent in 2024Q1 compared with 24.4 percent in 2023Q1. Hence, there is a need for conscious efforts to boost productivity across the tradable and non-tradable activity sectors in Nigeria.

Find a blog post

Latest Releases

_1731941578.png)

Leveraging Artificial Intelligen .. Read

4 days ago

Second Consecutive Increase: Hea .. Read

1 day ago

The Dynamics of Access and Influ .. Read

4 days from now